As the world is facing the crucial question of how to cope with global warming and the worsening state of the environment, the urgent actions on sustainability are gaining prominence. Consumers and companies are beginning to understand the significance of decreasing the size of their carbon emissions, and are engaging in this process by making an effort to achieve the goal of preserving the planet by themselves. With “Commit to Sustainability with Green Loans” from Handy Finance, overcoming the financial barriers to such measures is made easier, helping to put green ideas into action through consistent efforts.

1. Renewable Energy Investments

Among them, a green loan is often added to the list of one of the core purposes, which is the contribution to finance renewable energy projects. Either you are thinking about putting in solar panels, buying windmills or even experimenting in other ways of clean energy. There are different specialized loans that will provide the finances you are looking for in your green dreams. Thus, apart from reducing your dependence on fossil fuels, you create a better future, which has cleaner and more sustainable practices to be used by our generation now and those to come.

2. Energy Efficiency Upgrades

Besides renewable energy projects, green loans are likely to be also applied for energy efficiency enhancing. By renovating your old appliances with more energy efficient devices or improving insulation and weather proofing, you can save a lot on energy bills with these loans. Look for green loans and other green schemes which may be available in your area to make energy-saving changes.

3. Sustainable Transportation Solutions

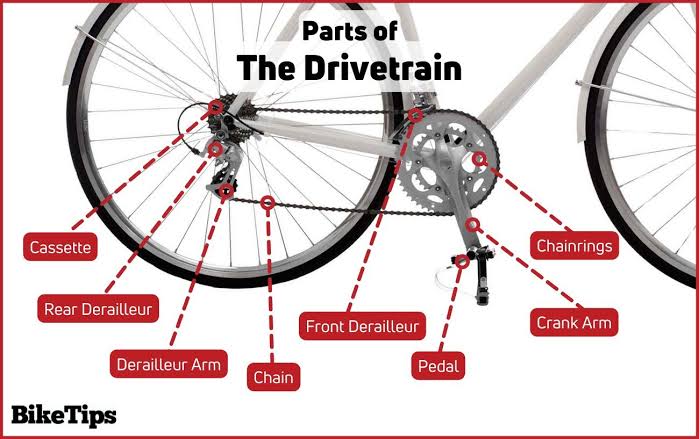

Transportation is playing a great role in contributing to greenhouse gasses and air pollution. Green fundings can facilitate the procurements of electric cars, hybrid cars, or cycling vehicles acting as ecologically diverse options in place of the commonly used energy-consuming cars. Through providing sustainable transport modalities, you are able to lessen the negative impacts that occur to the planet while the nearby convenience and affordability of this innovation makes it a popular option.

4. Green Building/ Re Roofing Projects

No matter if you will make a new green building from scratch or if you are going to modify the existing structure by introducing sustainable facilities the green loan will provide the necessary credit that will support your project. You can choose to implement the use of recycled materials, energy-efficient insulation, rain-water harvesting systems and green roofs all through these loans, which will help build friendlier ecological systems that cause less damage to the Earth.

5. Tax Incentives and Rebates

In many areas, governments and local agencies sometimes provide fiscal benefits, including grants or tax rebates, to help companies that opt for economic practices and technology that are environment friendly. Eco-loans keep you in the loop of the financial benefits of this concept.

Conclusion:

In the context of widespread environmental problems worldwide, the sustainability approach is not just a good choice anymore – it’s a necessity in the face of imminent challenges. Green-loans, which are a powerful financial tool, help green aspirations of individuals by providing the needed financial assistance in accordance to the individual requirements and planning.